Welcome

Welcome to AlgoCloud (AC for short).

AlgoCloud is an online cloud trading platform with one goal - to make algo trading simple!

By creating a new, no-code class of trading tools we want democratize and open the world of algo trading also for non programmers, and to make live trading simple and hassle-free, without the need for things like maintaining your own VPS, keeping your trading platform running and so on.

AlgoCloud has two main features:

-

No-code algo trading strategy creator / editor

It helps you to create your own algorithmic trading strategies in a simple way without any programming.

You can backtest your strategy on the fly, make changes, backtest it again, make changes again and so on until you are satisfied with the result.

-

Live trading on the cloud (currently in Beta testing)

You can deploy and run your algo strategies on live or demo accounts on supported brokers.

Our goal is to make live trading as simple as possible - without the need for running your own VPS servers.

What is a trading strategy?

Trading strategy is simply a set of trading rules - when to enter, when to exit, possibly when to move your protection stop etc.

So your trading strategy definition could look like:

When AAPL price today has risen more than 2% from its yesterday price, buy it.

it can also use indicators like:

When Simple Moving Average (SMA) with period 5 of AAPL crosses above SMA with period 20, buy the stock.

AlgoCloud allows you to define these rules like these in a simple way, you only have to construct them from the predefined blocks - conditions, values, comparisons, actions.

Note

If you have no previous experience with algo strategies you might run into a challenge that you must define exact rules.

If you come from discretionary trading, you might struggle with this at first - you have to be able to formulate and define EXACTLY what the strategy should check and do.

Quick platform orientation

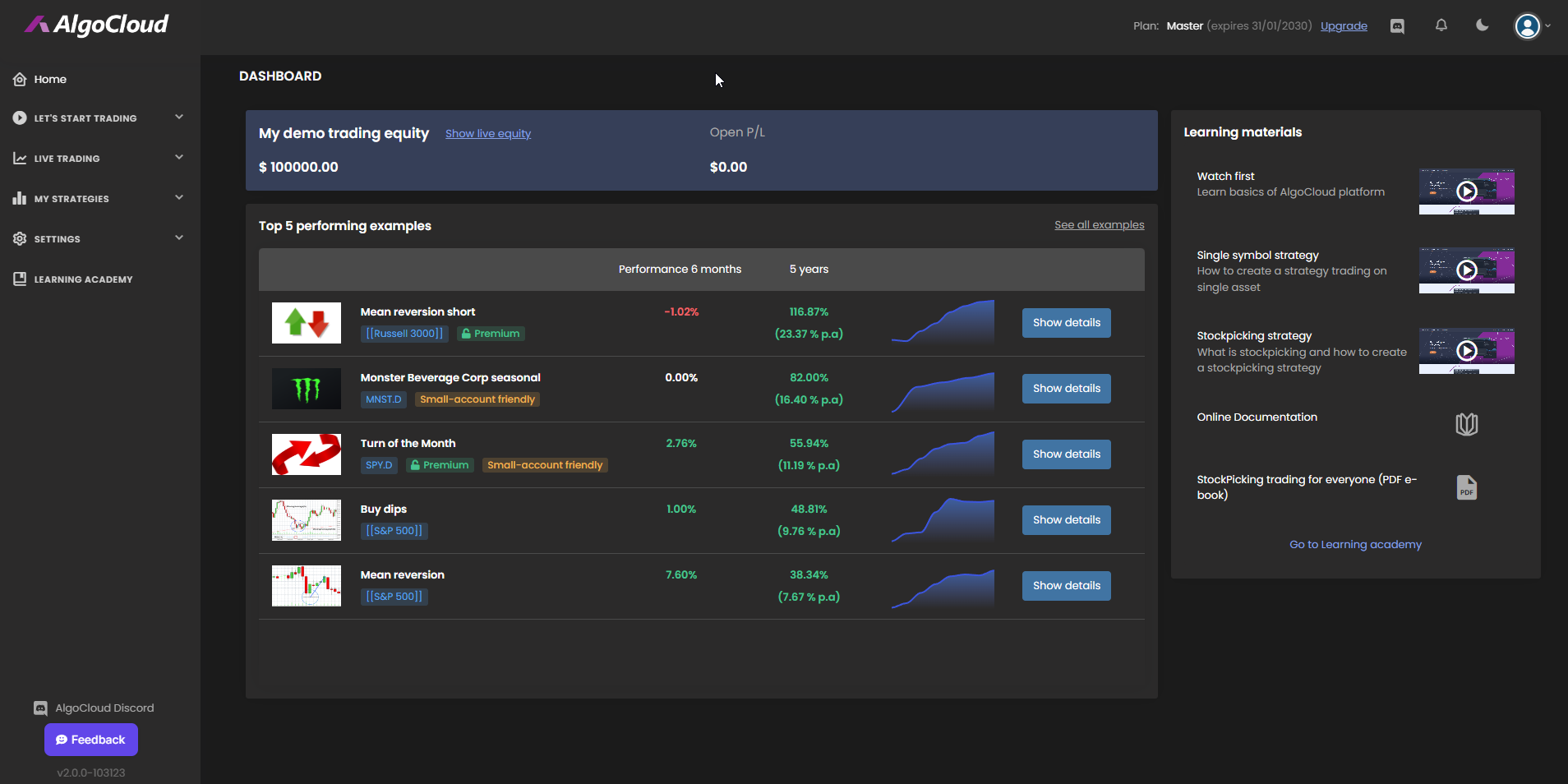

This is how main screen of AlgoCloud looks like:

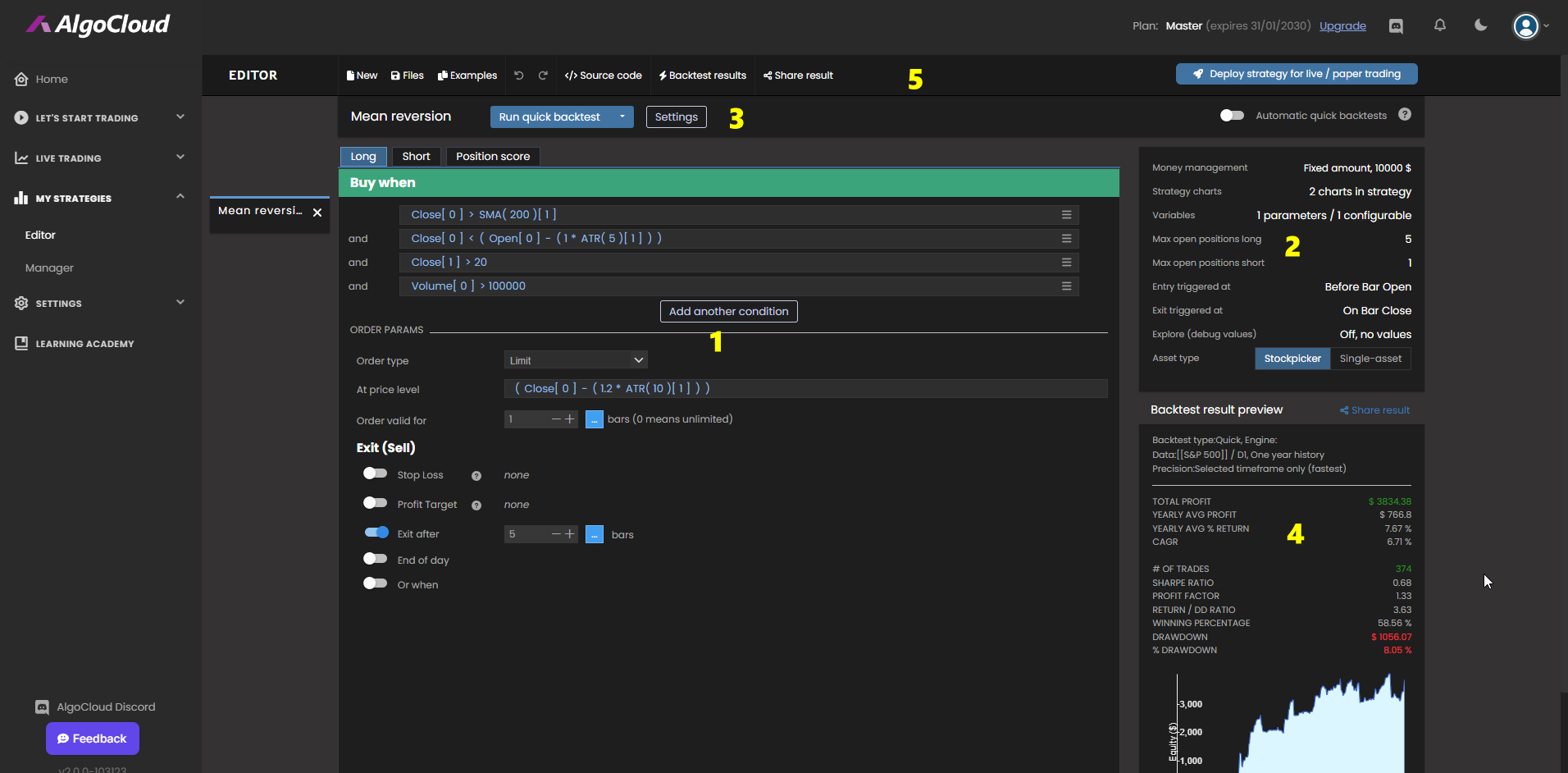

Editor tab is the core of AlgoCloud strategy editation/creation. Here you can create, modify and backtest your strategies. Let's look at the screen in more details:

- Editor area - this is where you edit your trading conditions. You can see on the screenshot that it is quite simple - just add conditions when to buy / sell and potential Stop Loss and Profit targets. Profitable strategies don't need to be overly complicated.

- Additional settings area - there are several additional things that can be configured for trading in addition to strategy rules. For example variables, Money management, other trading options.

- Testing toolbar - here you can run your quick or full backtests and configure all the backtest parameters.

- Results mini panel - it shows you the metrics and equity of your most recent backtest. You can click on it to go to the full results panel.

- Main toolbar - Icons and menus for standard things like working with files, showing results, sharing and the actual amount of your SQCoins (backtest credits).

Other learning resources

AlgoCloud Learning academy (video course)