Single-asset cloud strategy

This is a type of strategy that trades one stock symbol.

It can have additional subcharts attached - for example you can trade AAPL and look at MSFT and GOOG subcharts.

This is exactly a kind of strategy from our example earlier:

When AAPL price today has risen more than 2% from its yesterday price, buy it.

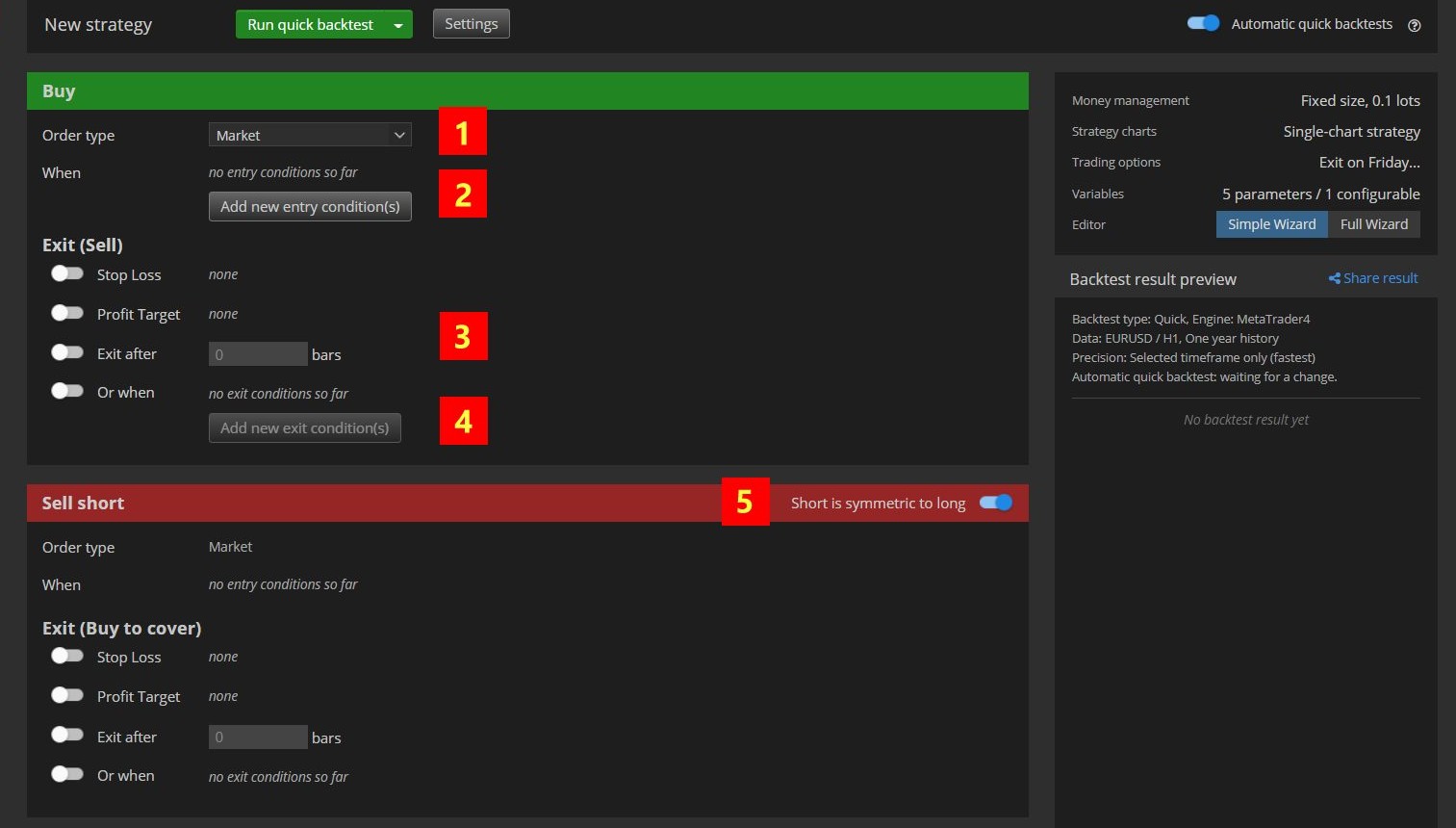

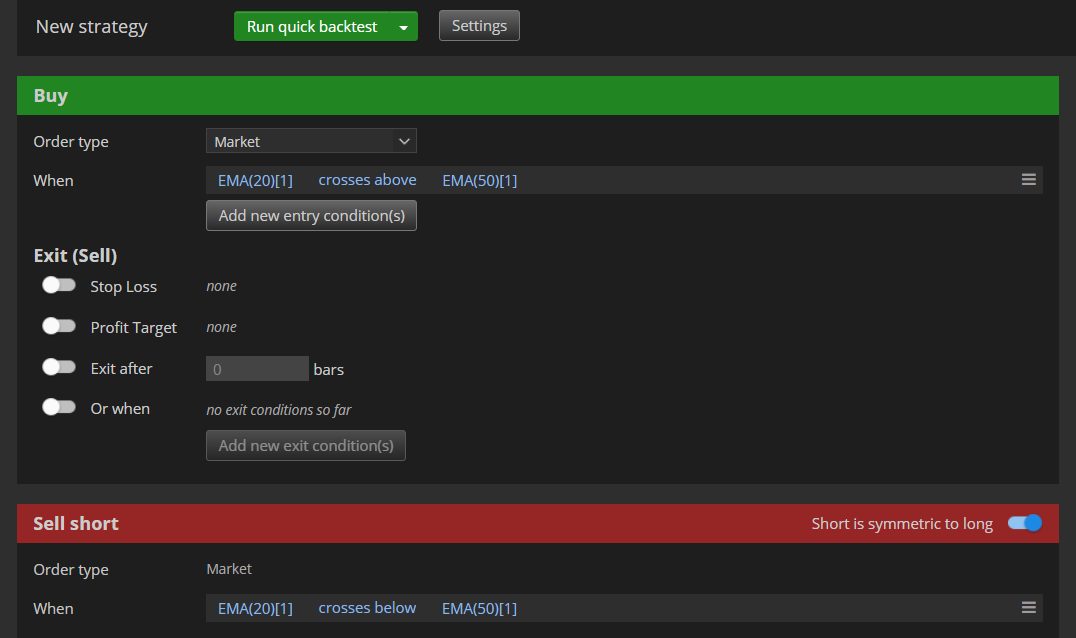

Editor wizard is as simple as it gets. There are only two sections - one for configuring Buy (Long) orders, and the other for Sell (Short) orders.

Layout

Orientation on the screen:

- Order type - the first thing you can configure is order type. You can use Market, Stop or Limit orders. For Stop/Limit orders you will also have to specify its stop/limit price level.

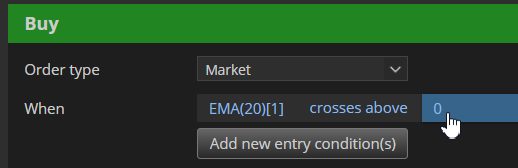

- When condition(s) - here is where youu can specify conditions that have to be valid to open the Buy trade. The condition can be simple, for example "CCI(20) crosses above 0" or it can be more complex.

- Exit types (optional) - you can optionally use any of the predefined exit types - Stop Loss, Profit Targer or exit after given number of bars.

- Exit when conditions (optional) - you can additionally enter another set of conditions that have to be valid to close the trade, for example "CCI(20) crosses below 0".

- Sell short section - Sell section is identical to Buy section, with one additional possibility - you can configure Short rules to be symmetrical to Long. If enabled, Short section will be not editable and instead of that AlgoCloud automatically creates all its conditions to be symmetrical with the Buy conditions and exits. So for example, if your Buy condition is "CCI(20) crosses above 0" then your symmetrical Short condition will be "CCI(20) crosses below 0". AlgoCloud saves a lot of duplicate work of specifying the Short conditions yourself, and you should use it (it is turned on by default) if you don't have some special strategy that uses Sell orders that are not symmetrical to Buy orders.

Working with conditions

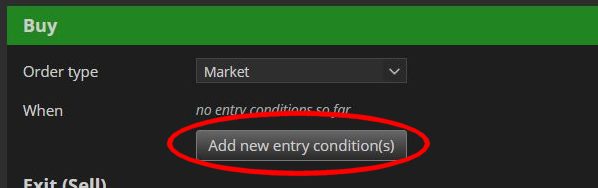

To add some condition click on "Add new entry condition" button.

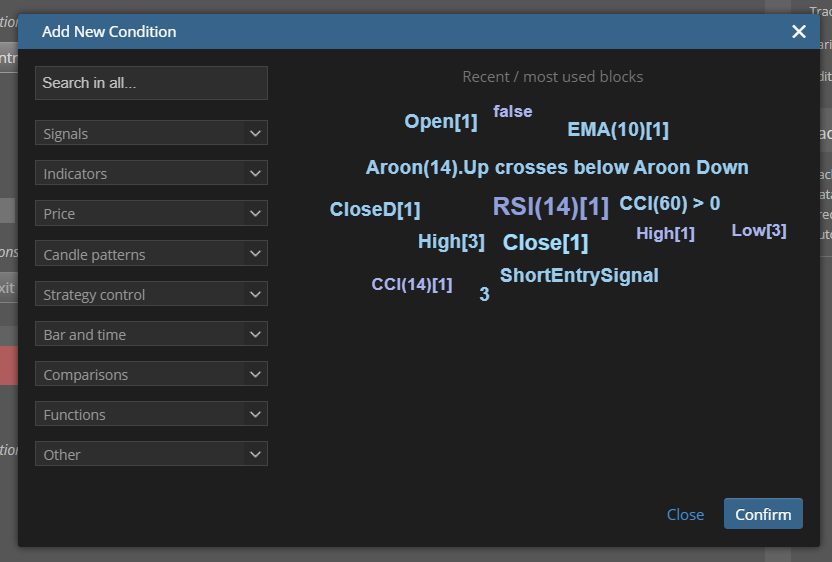

This will open dialog where you can choose or construct your condition from the predefined existing building blocks:

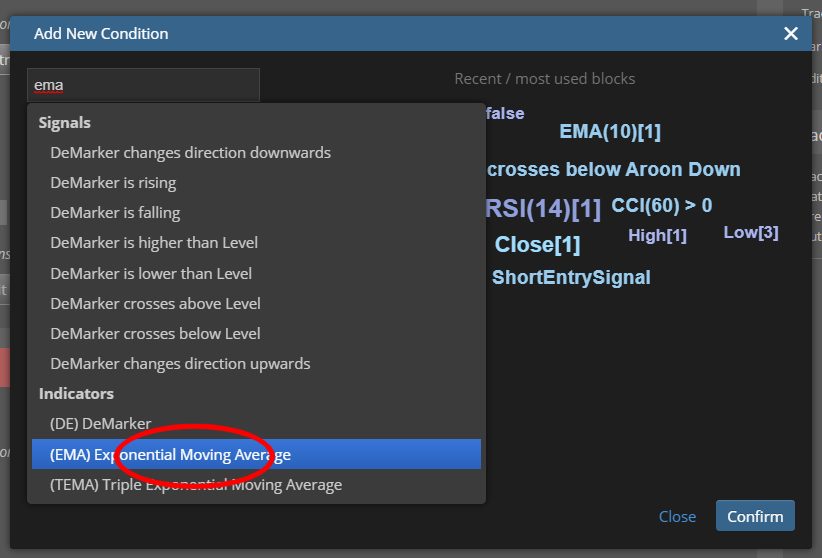

On the right side there is a tag cloud of most recently used conditions and blocks. On the left side there is a search field and a number of list boxes, each with a different category of building blocks. Just as an example, let's try to construct simple condition EMA(20) crosses above EMA(50). The easiest thing to do is to use the search field on the top, just go there and start typing "EMA" ...

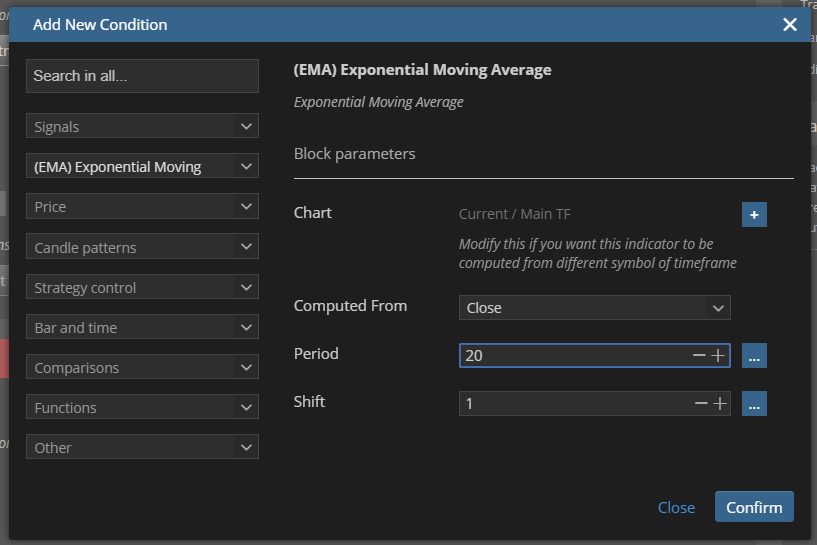

Now select EMA indicator from the list. It will be selected and on the right side you can see all the parameters of this block. EMA has several parameters, we want to use EMA with period 20, so we'll edit the Period field and type 20 there. Then we can click on Confirm to confirm adding this block to the strategy.

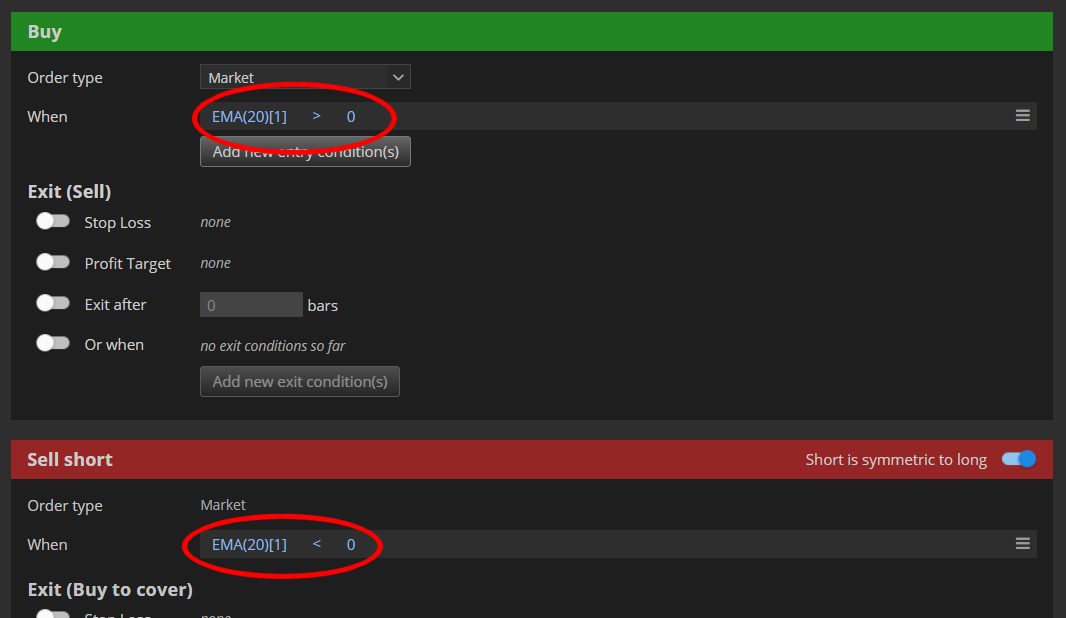

The new condition with EMA was added to the strategy:

Note two things:

- Symmetric condition for Short rule was also automatically created!

- It is still not the final condition. We wanted to create condition EMA(20) crosses above EMA(50) but we have EMA(20) > 0 instead. It is because so far we only chose EMA indicator. AlgoCloud added some default comparison and right side, and we can change it now.

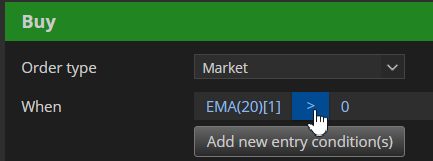

Simply click on the comparison to edit it:

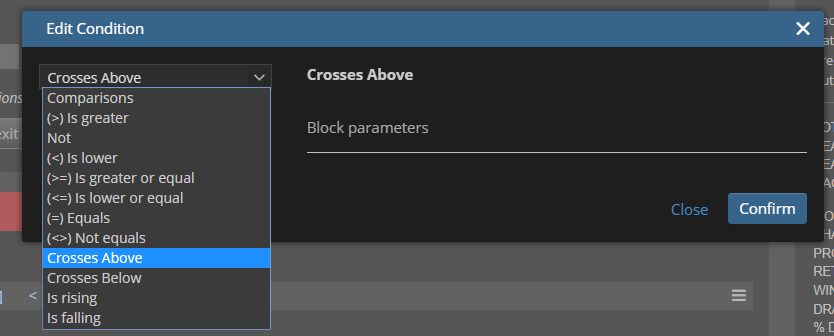

A dialog for editation of condition will be opened. There select Crosses Above instead of Is Greater and click on Confirm:

Our condition was updated. Note that also condition in the Sell order is updated after a while. The remaining thing is to modify the right part of the comparison. So in the same way just click on the right side:

And as same as before search for EMA, select it and change its Period parameter. When it is done the result will be the conditions we wanted in both Buy and Sell short orders: