Backtesting

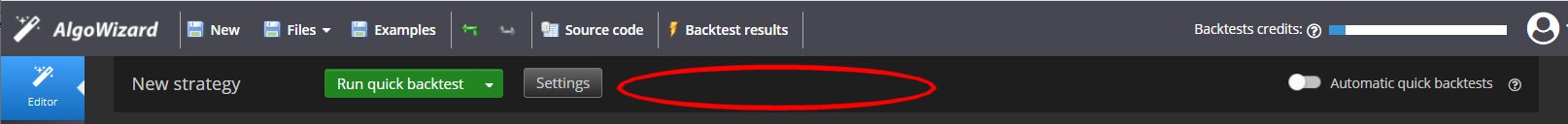

AlgoCloud allows you to use backtesting engine with build-in high quality historical data from various providers. You can configure the backtests extensively using the Backtests toolbar settings. You can even turn on automatic backtests that will run quick backtest of your strategy upon every modification.

There are few main concepts you should familiarize with when working with AlgoCloud:

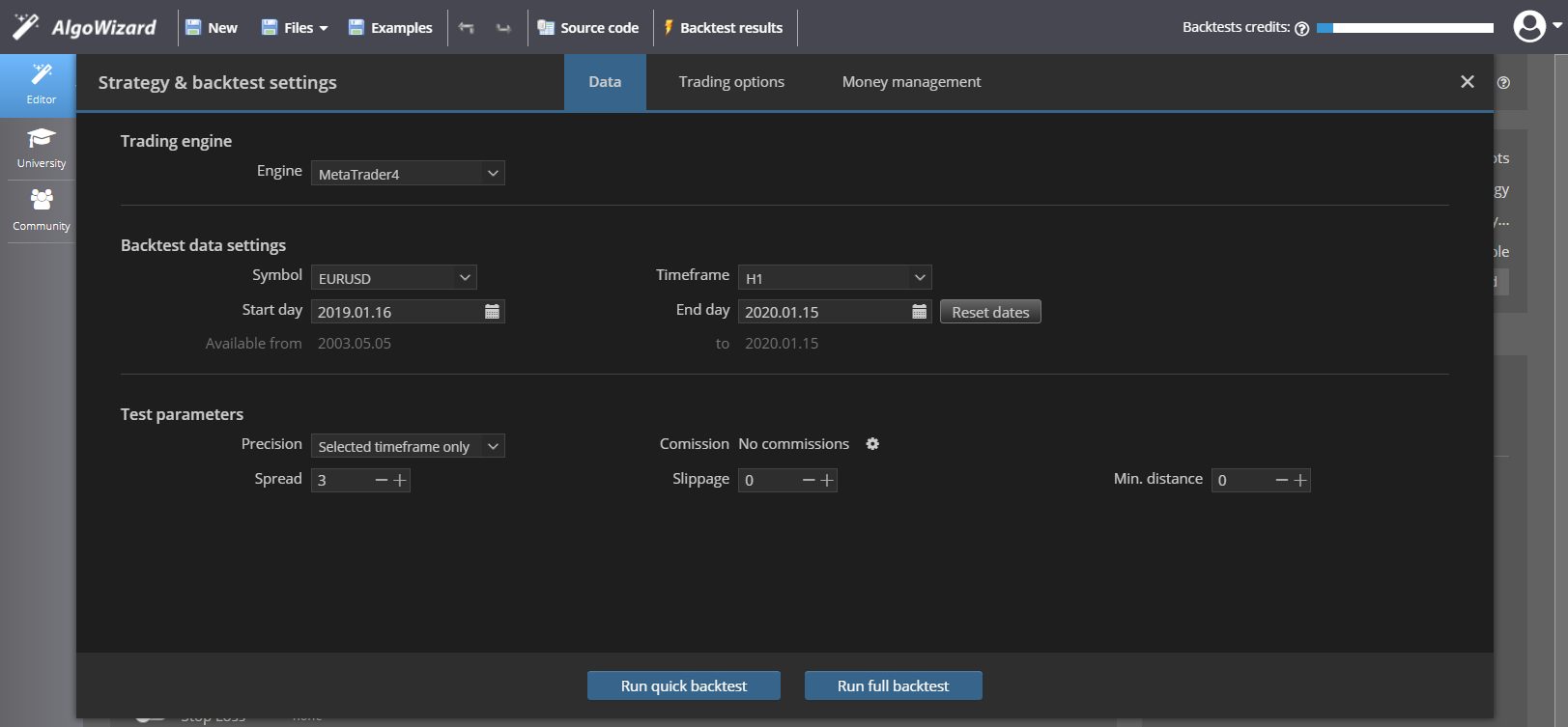

- Backtest is a result of strategy test on historical data. The exact backtest configuration can be done in backtest setting (point 3 in the image above). There you can configure symbol, timeframe, date range, spread and many other things.

- Backtest credits Because backests run on our cloud servers, there are daily limits on number of quick and full backtests you can make, depending on your plan.

-

Backtest precision there is currently only one possible precision - Selected Timeframe, which means the backtest is simulated on the candles of your timeframe. So if you have H1 (hourly) bars, bacttest engine will simulate 4 ticks per every hourly bar.

-

Full / Quick backtest there are also two backtest types:

- Quick backtest makes a very quick backtest on last year of data with Selected Timeframe precision. It uses low resources and it can be turned on automatically - which means it will be performed every time you modify the strategy.

- Full backtest is a backtest on the defined history range, which could be 17 or more years for forex data. You can also configure it to use the higher 1 Minute precision.

- Simple / Full Wizard AlgoCloud has two editors in one application.

- Simple Wizard - can be used for strategies that don't require complicated internal logic.

- Full Wizard is little bit more complex, it gives you the possibility to specify unlimited number of rules that are evaluated on each bar.In each of these rules you can open or close your position, or perform some other checks and computations. This way you can create strategies with very complex internal logic. Full Wizard is explained more in its own section of this help.

Backtest settings

Note that some options might be enabled only in higher plans There are few main backtesting concepts:

- Backtest is a result of strategy test on historical data. The exact backtest configuration can be done in backtest setting (image above). There you can configure symbol, timeframe, date range, spread and many other things.

- Backtest credits - SQCoins Because backests run on our cloud servers, we introduced SQCoins "currency" that is used to measure the processing utilization a backtest requires. The utilization amount and number fo SQCoins spent in one backtest depend on the number of ticks simulated, so it depends the length of history data used and on backtest precision (not timeframe). Every user has a certain amount of SQCoins per month that he can spend. When you spend all your coins you will be not able to make any more backtests for the rest of the month, or you can purchase additional SQCoins. Example estimates: Quick backtest on one year data EURUSD/H1 with lowest precision: 1-3 SQCoins Full backtest on whole EURUSD /H1 data (17 years) with lowest precision (only Pro version): 50 SQCoins Full backtest on whole EURUSD /H1 data (17 years) with minute precision (only Pro version): 3000 SQCoins

- Backtest precision there are two possible precisions:

- Selected Timeframe, which means the backtest is simulated on the candles of your timeframe. So if you have H1 (hourly) bars, bacttest engine will simulate 4 ticks per every hourly bar.

- 1 Minute, which means backtest engine simulates 4 tick every minute, so it looks for movements also inside the one hour bar. It is not always necessary to use the highest precision to test your strategies.

- Full / Quick backtest there are also two backtest types:

- Quick backtest makes a very quick backtest on last year of data with Selected Timeframe precision. It uses low resources and it can be turned on automatically - which means it will be performed every time you modify the strategy.

- Full backtest is a backtest on the defined history, which could be 17 or more years for forex data. You can also configure it to use the higher 1 Minute precision.

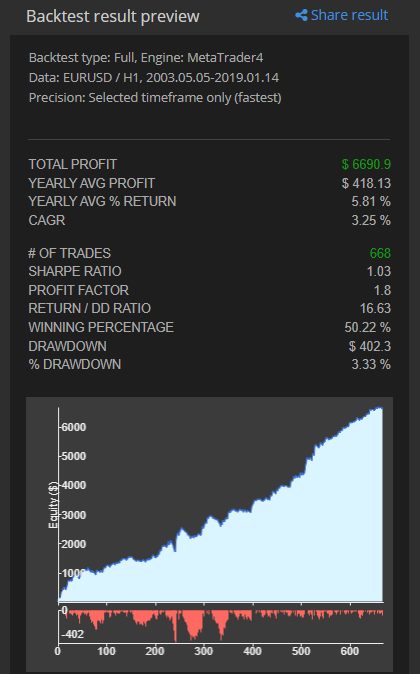

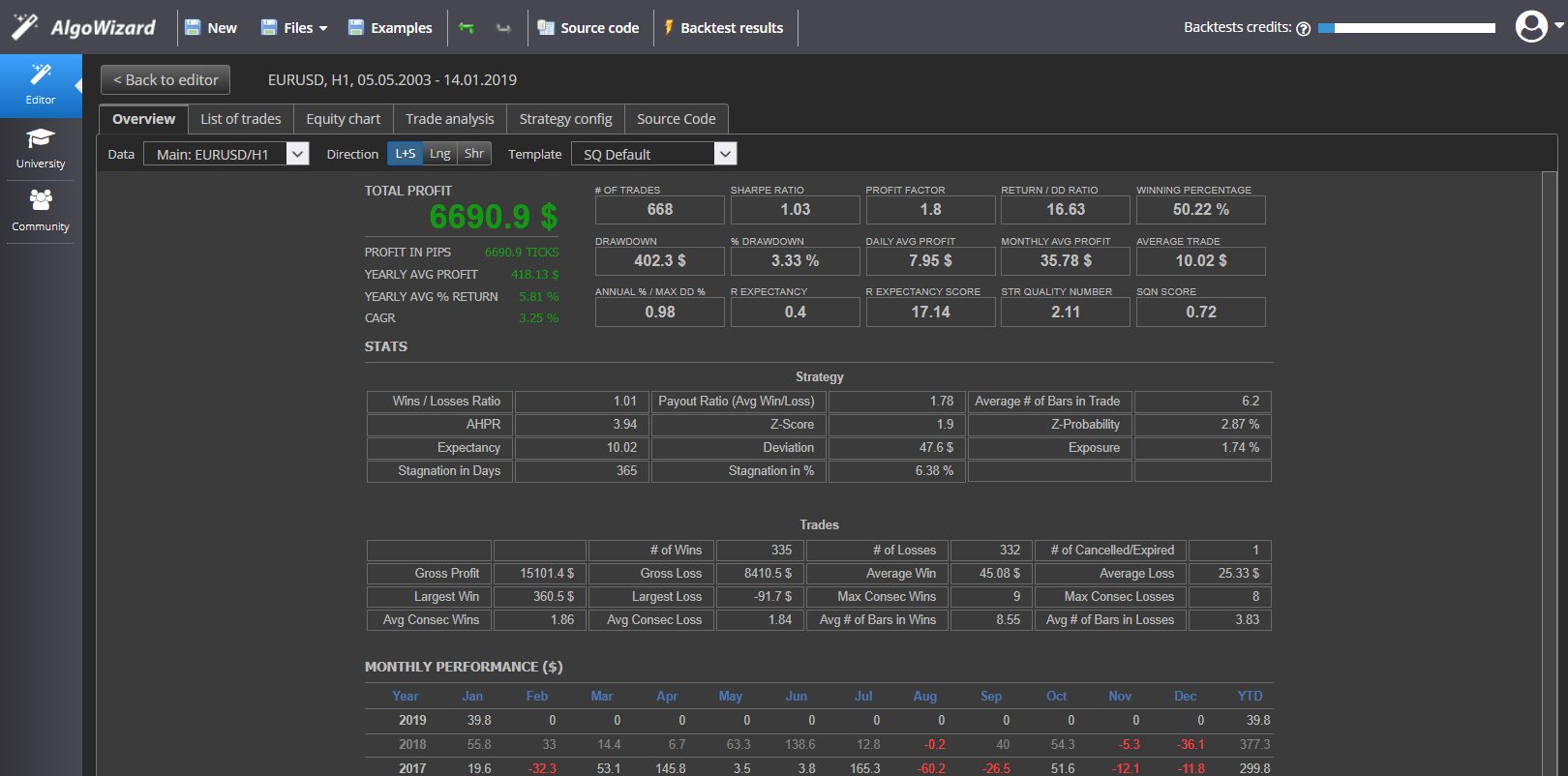

Backtest results

Backtest results are previewed on the ain editor screen on the bottom right section:

By clicking on it you can switch to full Results view with more detailed analysis of strategy performance.

Overview screen

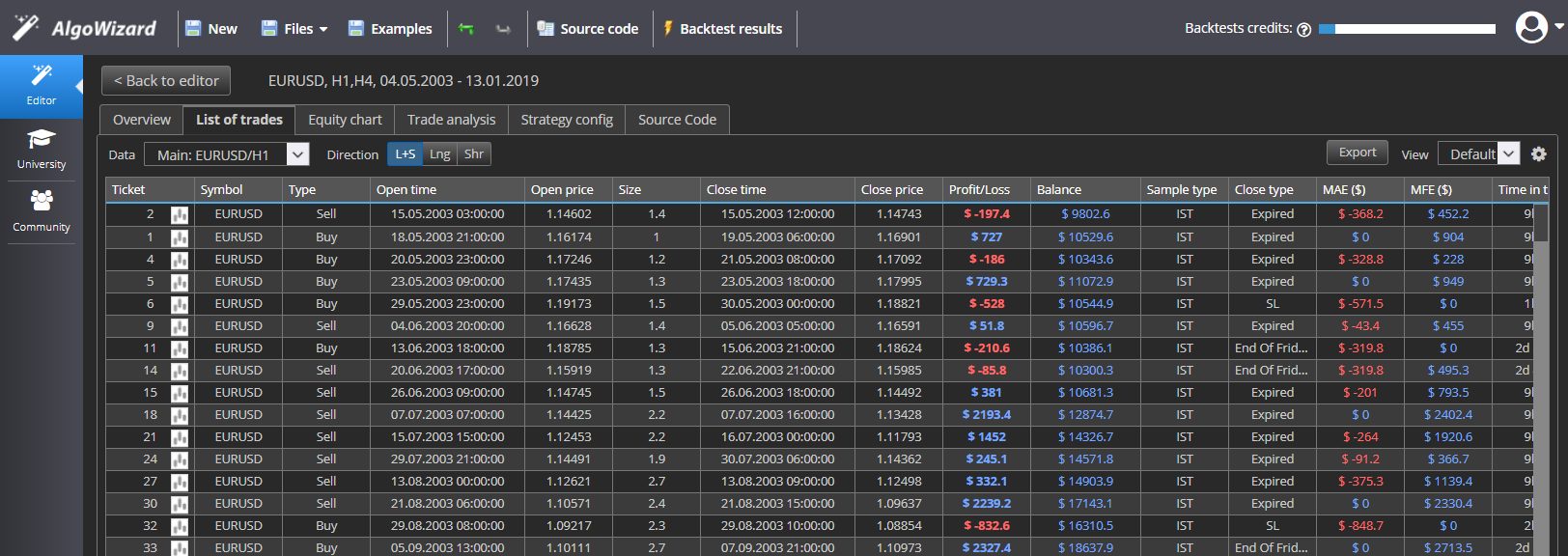

List of trades

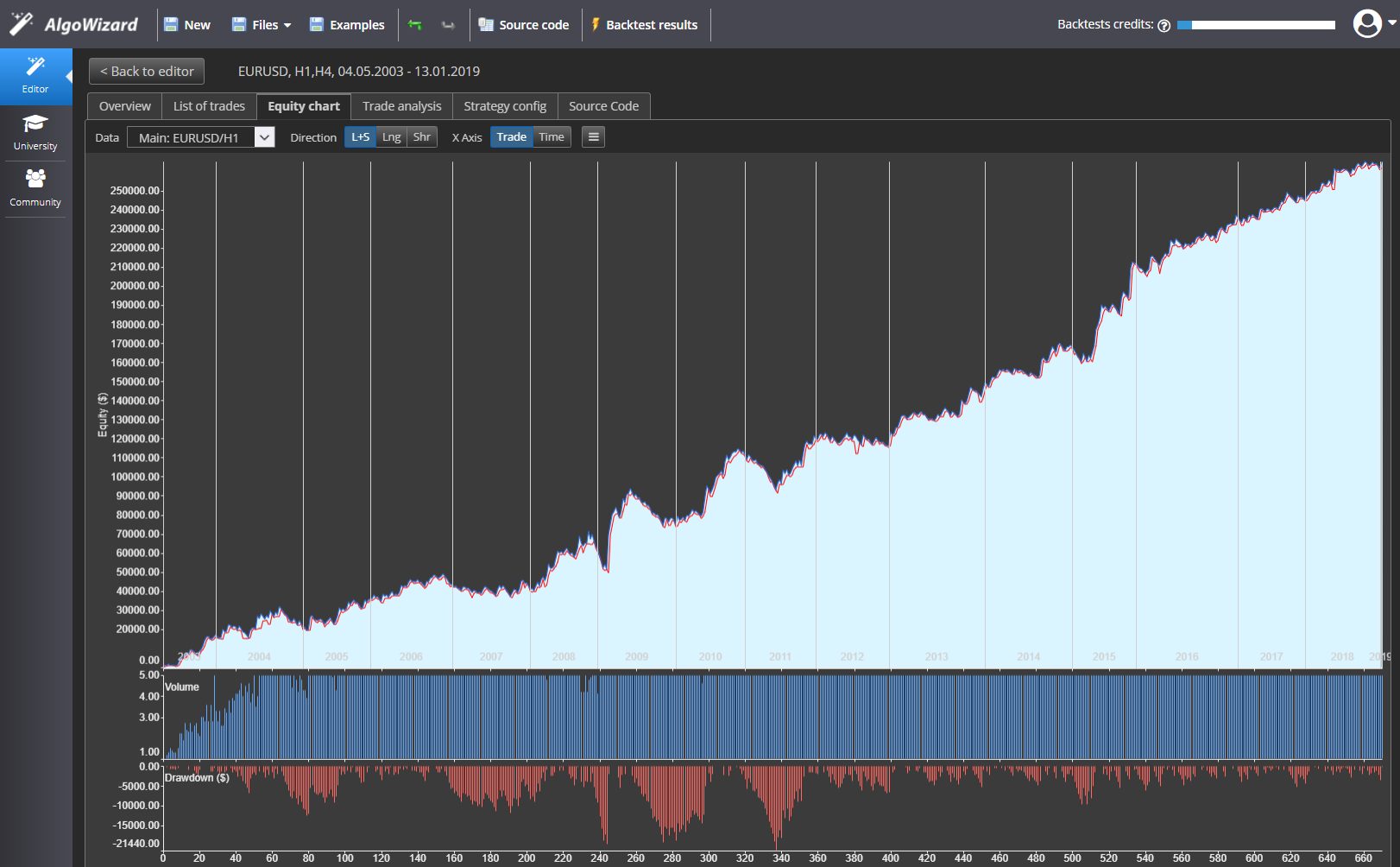

Equity chart

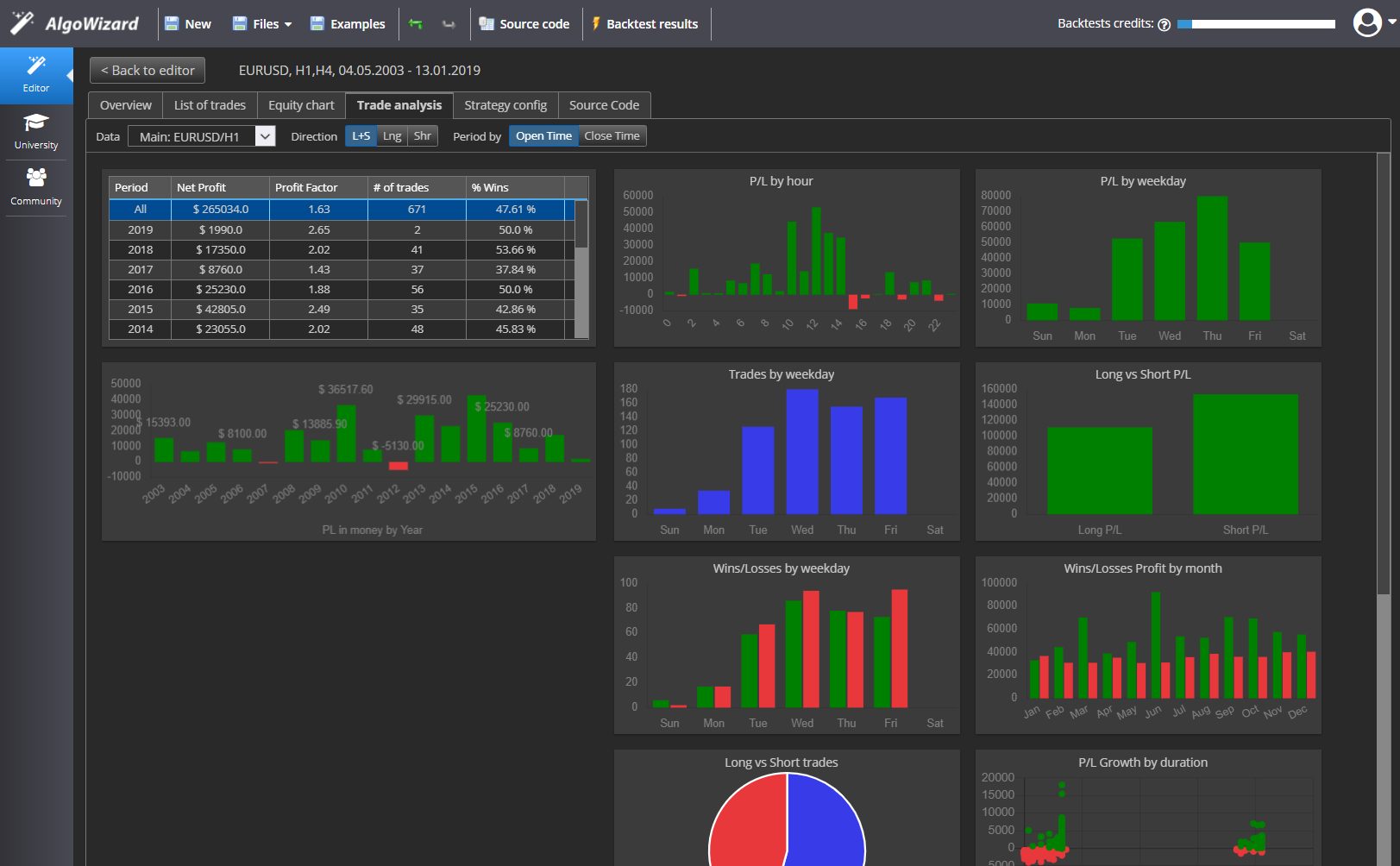

Trade analysis

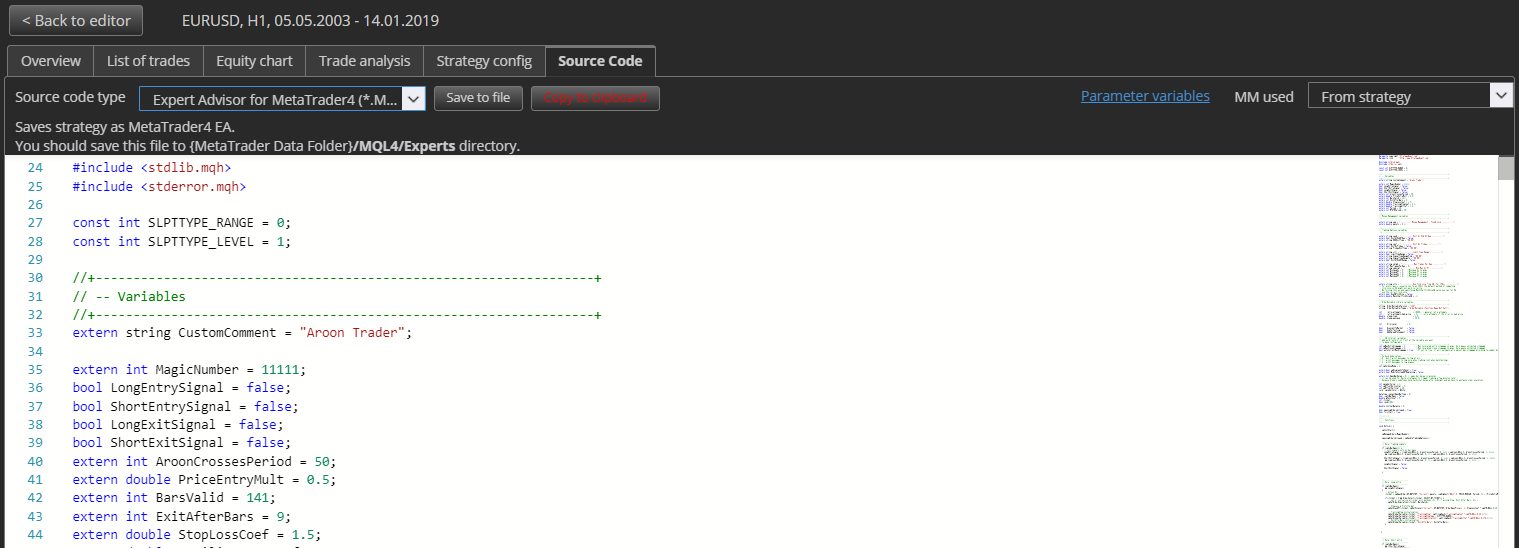

Source code

The very last tab Source code contains full source code of the strategy for each of the supported trading platforms:

You can Copy & Paste or save it to a file and retest or trade the strategy in your own trading platform.